On the Back of the Gray Rhino: Financial Market Vulnerabilities & Innovation-Driven Entrepreneurship

Working Paper

December 2021

Authors: Nashwa Saleh, Regie Mauricio, and Dina H. Sherif

I. INTRODUCTION

Academics and financial analysts have always been fond of extracting metaphors for financial markets from the animal kingdom: “bulls“ for rising markets, “bears“ for falling markets, and “black swans.”[i] In the current COVID-19 financial market crisis, “grey rhinos,“ a term coined by Michelle Wucker, has gained popularity. A grey rhino serves as a metaphor for missing “the big, obvious thing that‘s coming at you [which] gives you a choice: you get trampled, move out of the way, or hop on the back of the rhino and use the crisis as an opportunity.”[ii] It is still early to gauge the “size“ and full-fledged impact of the “rhino“ or a financial crisis that is likely to come on the back of the pandemic, but few would argue that this pandemic will result in untold economic hardship for a while.

The sudden economic shocks and uncertainty around the COVID-19 pandemic have severely weakened emerging market economies (EMEs).

These countries do not have access to the same resources as developed market economies (DMEs), rendering them less resilient to pandemic-level shocks. Without adequate resources, economies worldwide have struggled to provide short-term livelihood support and the public health protection needed to respond to the virus‘s adverse effects.

The challenges faced by EMEs require urgent, scalable solutions beyond the current capacity of governments. The opportunity facing EMEs lies in their ability to embrace a type of entrepreneurship that solves the fundamental challenges confronting beleaguered economies, including healthcare, education, commerce, and financial services. “Innovation-driven entrepreneurship” meets this challenge by offering novel, scalable solutions that can bring value to local users as well as those around the world. Innovation-driven enterprises are resilient to external shocks and offer a promise of financial sustainability that will, in turn, deliver value to economies in need.

This working paper will identify the significant challenges facing financial markets and determine how innovation-driven enterprises can help address them. The churn of financial markets creates opportunities for entrepreneurs seeking to repair the underlying enablers of economies weakened by the pandemic. By harnessing the power of the gray rhino and using the crisis as an opportunity, entrepreneurs are uniquely positioned to mitigate the myriad effects of the financial crisis.

II. KEY STRUCTURAL VULNERABILITIES

Emerging market economies face many structural vulnerabilities that predate the pandemic. First, global leverage was at an all-time high of 322% at the end of 2019.[iii] Second, governments have treated and addressed this crisis as a short-term liquidity problem when it is a long-term solvency issue masked by forbearance measures. Third, a plunge in cross-border financial flows is protracting economic losses in struggling economies. Addressing these structural challenges is critical to paving a pathway to economic recovery.

Leverage at All-Time High

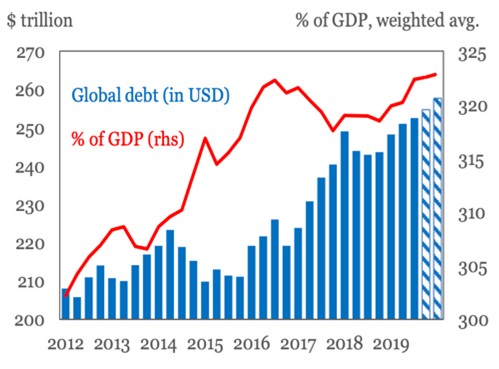

By the end of 2020, the global debt reached 277 trillion USD, 365% of world GDP.[iv] Prior to the pandemic, the world was still highly over-leveraged at the end of 2019, with the global debt to GDP ratio at an all-time high of 322% of GDP (see Figure 1).[v] This debt has been building in EMEs after the GFC, with the ballooning of sovereign debt and central bank balance sheets. The global leverage glut exacerbated by the pandemic‘s impact poses a severe threat of a prolonged period of financial repression and debt unsustainability in EMEs for the medium and long term. Notably, this phenomenon will increase the cost of borrowing for average people in EMEs, especially entrepreneurs who undertake risky ventures.

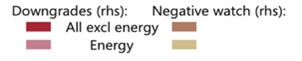

Liquidity Versus Solvency Challenges

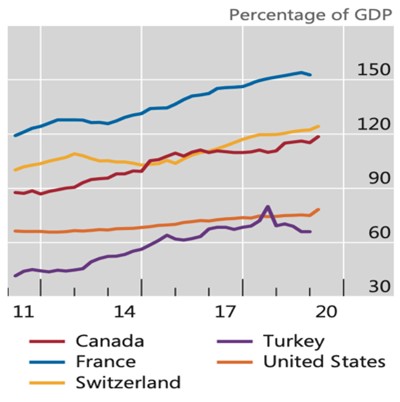

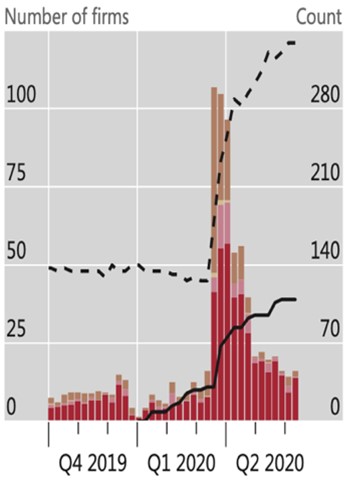

Governments have addressed the financial fallout from COVID-19 as a short-term liquidity crisis; however, the reality is a long-term solvency crisis disguised under forbearance measures. Even if governments manage to meet the challenges posed by the economic fallout today, they will still need to address insolvency issues for years to come. Since the onset of the pandemic, publicized bankruptcy filings have been only the tip of the iceberg. As updated data sets trickle down to balance sheets, there will be some degree of institutional failure and another wave of forbearance measures and bailouts (see Figure 2).

There has been a sudden halt in domestic economic activity as governments anticipate managing longer-term challenges. Commodity prices have dropped for exporters, tourism is on hold, and currencies worldwide are vulnerable to devaluation. Governments are also running higher budget deficits as they spend more to combat the effects of the pandemic while expecting less tax revenue than before; therefore, national budgets are accruing increasingly more debt. This pressures governments to increase revenues, often by instituting onerous tax policies that disproportionately impact innovators.

Though EMEs must address challenging domestic contexts, they do have some insulation from global economic meltdowns. Many EMEs have limited exposure to global financial markets. This insulation is why they fared so well with little contagion from the ripples of the GFC back in 2008. Smaller EMEs have nascent debt capital markets and credit risk culture, enabling them to make limited use of secondary trading of debt instruments. Being relatively isolated from powerful but volatile financial markets, EMEs avoid direct exposure to such fluctuations during the pandemic.

Focusing on domestic economic activity will be a priority for EMEs. The banking sector in these markets is primarily equipped for domestic issues, and the crisis will unfold as a slow-burn increase in non-performing loans and clean-up over several years. Economic stimulus and prudent monetary policy will be essential for governments looking toward pandemic recovery.

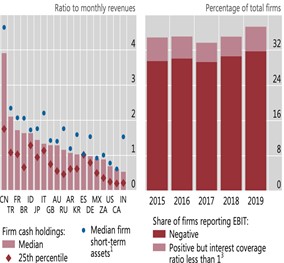

Portfolio and Cross-Border Financial Flows

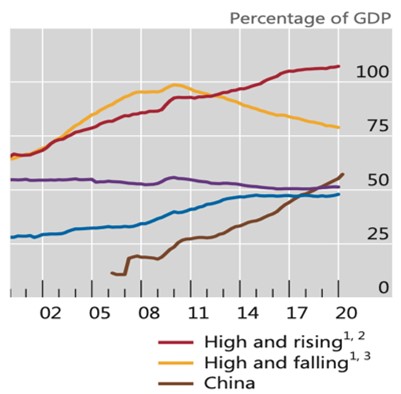

Cross-border financial flows to EMEs have become increasingly difficult since the GFC. With the rollout of Basel III regulations, cross-border flows between DME and EME financial institutions had become prohibitively expensive. This reduction resulted in favoring larger institutions and large transactions. Global cross-border banking claims booked 28.5 trillion USD by the end of 2018. Two-thirds of these transactions were large ticket bilateral relationships of 117 institutions, which were each greater than 50 billion USD.[vi] Non-traditional players such as asset managers and insurance companies moved in to fill the gap created by banks‘ reduced engagement. Non-bank financial institutions provided 35% of total cross-border lending at the end of March 2019, which increased from 30% in March 2016 (see Figure 3).[vii] This trend is expected to continue.

When the pandemic began, investors moved to de-risk portfolios. Equity and bond markets across DME and EME economies withdrew close to 200 billion USD in the first quarter of 2020.[viii] While the proportion of this amount exiting EMEs to the total is small, it is significant when considering these countries‘ relatively smaller capital markets, GDPs, and FX reserves. As this increasingly important source of cross-border financial flows grows wary of investing in EMEs, these economies are at risk of seeing protracted losses from a crucial source of finance.

The pandemic similarly impacted low- and middle-income countries’ remittance flows, estimated at 550 billion USD. Remittances are more significant than the total forecasted FDI and official development assistance flows. The top three countries in terms of outbound remittances were the US (68 billion USD), UAE (44 billion USD), and Saudi Arabia (36 billion USD), respectively, in 2018.[ix] The pandemic has reduced remittance flows to 7.2% to 508 billion USD in 2020, which is further projected to decline 7.5% to 470 billion USD in 2021.[x]A potential $80 billion drop in remittances could put pressure on EME currencies, making business and cross-border trade more expensive for EME entrepreneurs.

III. IDES CREATING FUNDAMENTAL MARKET ENABLERS

The Role of Innovation-Driven Entrepreneurship

These macroeconomic issues require immediate action to stem the increasingly protracted outlooks for the economic crisis considering the pandemic. As governments worldwide attempt to address these challenges, their efforts alone will not repair financial markets and deliver the resources needed by vulnerable firms and households on the ground.

Innovation-driven entrepreneurship (IDEs) present a part of the solution. IDEs have the flexibility and problem-solving capacity needed to address root issues at scale.

A venture-powered approach may be favorable in countries where national governments lack the resources to coordinate initiatives to address fragile financial markets. With policymakers‘ support, IDEs can create the fundamental market enablers that allow EMEs to access financial resources during the tails of a pandemic which could possibly become endemic in some form, similar to the flu.

The global leverage overhang in EMEs provides an opportunity for IDEs to engage in alternative lending products for businesses and individuals. These include peer-to-peer lending, invoice-backed lending, trade finance lending, payday loans, cooperative savings, and lending platforms. The market size for digital lending in the coming five years is estimated to be 1 trillion USD.[xi]These forecasts are bound to have moved upwards since the beginning of the pandemic. These entrepreneurial ventures can also work to make sending remittances easier and cheaper. These alternative lending and remittance products can also act as a channel for the cross-border flows that have decreased due to the economic crisis. By opening these new finance channels for businesses and individuals, EMEs can rebuild their economies from the bottom up.

It is important to note that creating alternative lending products will come with challenges. Credit scoring, credit assessment, and information provision on borrowers can be difficult in EMEs. This data is not available from traditional sources, and there are only recently a handful of players who can deliver this information. With the challenge, there is also the opportunity for entrepreneurs to address this pain point as well. Entrepreneurs engaged in these fundamental market infrastructure enablers could create solutions for lenders and borrowers to facilitate the increase in alternative lending.

A Growing Industry

Entrepreneurs around the world are working to scale innovations that can address financial market fallout. For example, Funding Circle’s mission is to create a lending platform that is better suited to small businesses. The company’s founders Samir Desai, James Meekings and Andrew Mullinger, observed small businesses’ challenges when applying for loans after the GFC. The time, resources, and documentation required to secure this finance was already challenging for many fledgling enterprises before the pandemic. After the crisis, many business owners were in desperate need of short-term finance from a lending market undergoing shock while contending with several new regulatory policies. Funding Circle’s team wanted to create a more straightforward path to finance that could provide struggling businesses with the resources they needed.

The company uses machine learning and AI to assess risk more accurately and significantly reduce applicants’ transaction time and resources. After users complete a 6-minute application, the Funding Circle can recommend lines of credit, term loans, cash advances, and other financial products that best suit their needs. Since its founding in 2010, the company has lent 15.2 billion USD to 100,000 businesses around the globe.

Platforms like Funding Circle are not alone in their quest to provide alternative pathways to finance. As this industry grows, navigating this proliferation of solutions will become more overwhelming, and entrepreneurs are taking note.

In Mumbai, Turtlemint was founded in 2015 to help Indians navigate a complicated insurance market in the country. This company helps its users navigate the complicated market of car, bike, health, and life insurance in India. Only a small fraction of the country’s 1.3 billion people has access to insurance. As of 2017, 3% of the population had a form of insurance, the majority of whom spent less than 50 USD on their respective policies. Using an online application, Turtlemint gathers the necessary data on their clients’ needs to recommend suitable insurance products. The company has sold over 1.5 million policies and has raised 55 million USD in funding, 30 million of which was raised during the pandemic. Turtlemint’s success is a sign that more people are seeking alternative digital financial services products and need a way to navigate the growing industry. As the alternative lending sector grows, other digital financial services industries will grow in support, such as insurance.

A Call to Market Enablers

Companies like Funding Circle, Turtlemint, and others respond to a global need for more alternative digital financial services products and lending platforms. Alternative lending is a fast-growing sector that boasts over 104 billion USD in investment, most of which has been invested in the past four years. However, this growth cannot be sustained by investor capital alone. Policymakers must facilitate opening space for new market enablers to flourish. This starts with upgrading the digital infrastructure in EMEs; supporting an innovation culture and a level playing field for talent to avoid a ‘Fintech (Brain) Drain; and endorsing elemental players in the ecosystem to encourage professionalism, transparency and best practices in disseminating information, building industry credit risk profiles, and assessing individual borrowers credit risks. The latter might be through traditional credit rating agencies or more innovative AI and algorithmic assessments.

Export credit agencies and other specialized institutions should also provide backstop funding and engage further in credit enhancement offerings for borrowers. Banks should play a more prominent role in MSME financing, preserving systemic stability (less borrower concentration). Yet, one of the key bottlenecks for banks in the provision of loans to MSMEs is the high risk, and in turn, the capital allocation required. This concern could be reduced significantly with guarantees and other credit enhancement mechanisms, especially if designed to prevent moral hazards. These initiatives would allow actors in the existing landscape to gain comfort and continue to lend while new counterparts engage. Through this funding, policymakers can incentivize development in sectors affected by the pandemic, such as healthcare and education, and reinvigorate vulnerable sectors that are key to economic recovery. Finally, the adoption of responsible finance practices for digital financial services (IFC and G20 principles) would ensure that financial institutions do not result in the inclusion of unprepared participants, charged prohibitively high rates, who end up losing access to loans when they end up defaulting. Policymakers are accountable for ensuring the adoption of fair consumer practices.

IV. ON THE BACK OF THE GRAY RHINO

For EMEs with decades of regression on the horizon, this working paper paints a grim picture. While some will win big, many others will lose in this high-stakes period of change. Those who “hop on the back of the rhino” and can pivot the crisis into an opportunity for radical financial reform will have an opening to leap forward and potentially bypass some of the expected setbacks. The EMEs who stay where they are will get trampled.

Mitigating negative macroeconomic trends requires more than the initiative of innovation-driven entrepreneurs. Policymakers must rally the thinking and resources necessary to build enabling ecosystems for these enterprises to grow. Regulatory environments, digital infrastructure, and investment capital must align to allow these ventures to grow. However, an environment shedding business activity and employment opportunities cannot afford to waste time imagining innovative means to provide alternative lending, credit risk assessment, and remittances, which are the lifeblood to economies.

Hopping on the back of the rhino means empowering entrepreneurs and innovators with the agility to meet these pressing issues. The challenges presented by the pandemic are opportunities for ventures to create solutions that will bring value to vulnerable EMEs and contribute to their financial markets.

V. REFERENCES

[i] Taleb, N. (2007). The Black Swan: The Impact of the Highly Improbable. New York, Random House.

[ii] Wucker, M. (2016). The Gray Rhino: How to Recognize and Act on the Obvious Dangers We Ignore. New York, St. Martin’s Press.

[iii] Institute of International Finance (2020). “Global Debt Monitor Sustainability Matters – January 2020.”

[iv] Lu, M. (2020). “This chart shows how-debt-to-GDP is rising around the world.” World Economic Forum.

[v] Institute of International Finance (2020). “Global Debt Monitor Sustainability Matters – January 2020.”

[vi] BIS Quarterly Review (2019). “BIS Quarterly Review: International Banking and Financial Market Developments – June 2019.”

[vii] BIS Quarterly Review (2019). “BIS Quarterly Review: International Banking and Financial Market Developments – September 2019.”

[viii] BIS Annual Report (2020). “BIS Annual Report to Congress for Fiscal Year 2020.”

[ix] World Bank Group (2019). “Migration and Remittances: Recent Developments and Outlook – April 2019.”

[x] World Bank Group (2020). “Phase II: COVID-19 Crisis through a Migration Lens – October 2020.”

[xi] Boston Consulting Group (2019). “Digital Lending: A $1 Trillion Opportunity Over the Next 5 Years.”

ABBREVIATIONS

DME Developed Market Economy

EME Emerging Market Economy

FX Foreign Exchange

GFC Global Financial Crisis

MSME Micro-, Small-, and Medium-Sized Enterprises

SDG United Nations Sustainable Development Goal

Figure 1: Global indebtedness of sovereigns, corporates & households at an all-time high.

Sources: BIS Annual Report, June 2020, IIF Global Debt Monitor Sustainability Matters, January 2020.

Figure 2: The solvency crisis masked as a liquidity crisis.

Sources: BIS Annual Report, June 2020.

Figure 3: Cross-border financial flows are retrenching, and non-bank financial institutions fill the gap.

Sources: Concentration in Cross Border Banking, BIS Quarterly Review, June 2019.